Buying residential real estate may happen only a few times in your life. Because of how infrequently people purchase homes, they may need to remember what occurs during one, which can be an excellent refresher for anyone. Anyone who has gone through the process understands how eager the buyer and seller are to get to the closing table. After accepting an offer, you share this moment with your friends and family. Though transactions differ, considerable work tends to be done before you get to the closing table.

The components that generally take the most time are the due diligence period and getting final loan approval. Most people are so relieved to get to the closing table that they barely remember what happened. It’s understandable, especially considering how momentous the occasion is. With that in mind, here’s a brief explanation of what can happen when you finally sit at the closing table to get your new home.

What Happens At the Closing Table

When you attend a closing, typically, there will be several key people there. Although we included both in the list below, please note that the buyer and seller may choose to sign all the required documentation separately. For example, the seller may sign everything electronically before closing, meaning only the buyer must attend. Whereas everyone listed could be present, that doesn’t mean everyone will be. Still, these are all the people that make a residential real estate transaction possible.

The buyer

The seller

Real estate agents for both the buyer and seller

The closing agent (generally an attorney or someone who represents the title company)

The lender

The attorneys for both parties

A notary public

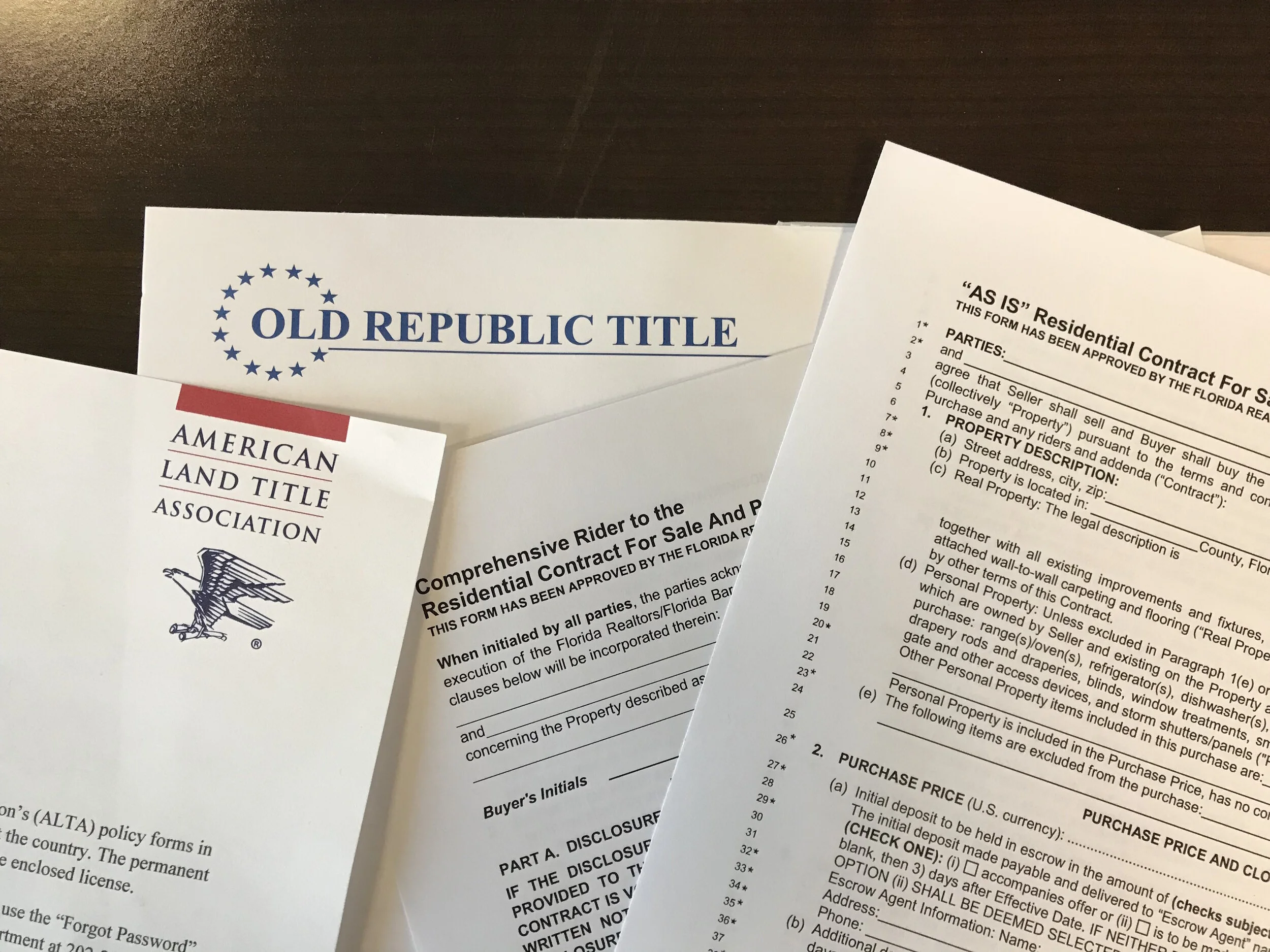

There will be a significant amount of paperwork involved. The types of documents that you are required to sign will differ by transaction, but here are several key ones that you can expect to see:

Deed

Mortgage

Closing Disclosure

Promissory note

Affidavit of title

Bill of sale

Title insurance policy

Any relevant disclosures

After all the paperwork has been signed, the buyer/lender transfers the necessary funds to complete the home sale. Your lender will provide instructions on how this will be achieved before the closing date. Because the title is everything, it must be transferred to the buyer after the funds have been successfully issued.

In addition to the seller getting paid, some of those funds that the buyer/lender provided get distributed to paying off any liens (e.g., the remaining balance of the seller’s mortgage), and the real estate agents are entitled to a percentage of the sale price. One of the best moments is when your real estate agent or attorney informs you that you are “on record.” The deed has been recorded in the county recorder’s office. People enjoy this part because it signifies that a transfer of ownership has occurred and that the public record reflects this. Lastly, you will receive the keys to your home. The rest is up to you.

We’re with You From Contract to Closing

Whether you are a first-time buyer or have purchased multiple investment properties, Spectrum Title Services, LLC, will be with you from the moment you have a signed contract until you discover you are “on record.” We have extensive experience with residential and commercial real estate transactions, refinancing, and title insurance. Contact us to speak with an attorney about any of the aforementioned legal services, and we will be happy to schedule a consultation with you.